The intention of the European Union in promoting a uniform regulation on late payment in B2B and B2G transactions is to foster the punctuality of payments, thus eliminating a factor of tension in financial management, especially of smaller enterprises. The legal instrument adopted in pursuit of these aims is the sanctioning of late payments, through the provision of a right for supplier companies to be awarded punitive late payment interest, as well as administrative compensation.

The logical assumption of the initiative is that late payment is a behaviour mainly due to the relational and dimensional asymmetry between 'strong' customer and 'weak' supplier and it is therefore sufficient to provide an instrument that legitimises the weak party's claim to compensation.

In economic reality, the problem is much more complex, also includes the initial determination of payment terms for services and supplies, and cannot be separated from the realisation that a very important part of supply relationships is nothing more than a single stretch within a longer chain.

Focusing on the single leg, ignoring upstream and downstream behaviour, significantly reduces the effectiveness of any regulatory provision. To assume that the 'normalisation' of any single stretch automatically translates into the normalisation of the whole chain is simply naive.

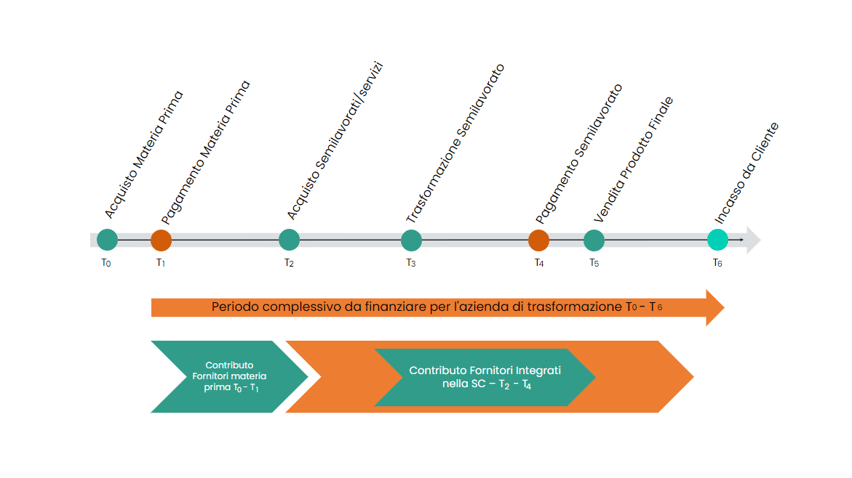

The following figure shows a highly simplified example of a manufacturing chain, which shows how the financing of the overall production cycle is always distributed over the different links in the chain, with different weights resulting from the diversity of volumes, but also and above all from the different level of involvement of suppliers. Suppliers of commodities and raw materials have no particular interest in supporting the customer who is, as a rule, easily replaceable. A marginal and easily replaceable supplier has no interest in supporting the customer, but can easily fall victim to late payment. A supplier in a supply chain is aware that the shared goal with the customer is the sale of the finished product and has an interest in contributing to the achievement of this result by participating, as far as possible, in the financing of the overall cycle.

The real problem is the financing of companies' working capital. A problem that can be accentuated by long payment terms and late payments, but which should not be confused with these factors. Payment terms and payment delays are some of the tools that companies use to manage the financing of working capital: focusing only on some of these tools does not help to understand the problem, nor to solve it.

Limits of Market Instruments for Working Capital Financing

The financing of working capital is one of the key factors in ensuring sound and prudent business management. Businesses die when they can no longer find a place in the market, but they also die (much more often) when they cannot manage their operational financial cycle, when the time gap between payments and receipts becomes too wide and the company cannot find the financial resources to cover this gap. Short-term financial strain is perhaps the main factor in the crisis, even irreversible, of Italian companies, and this is reflected in all credit risk scoring models, which tend to overweight the indicators measuring this phenomenon. It is a matter of managing the short-term liquidity that the company has (or does not have), of course, but also and above all of managing the factors that this liquidity generates (customer payments) or absorbs (payments to suppliers and inventories), without forgetting that long payment times imply a higher credit risk for the customer and correspondingly higher credit needs for the supplier.

The financial market offers a vast assortment of instruments suitable to support companies in the management of working capital (such as bank advances, factoring, reverse factoring, confirming, letters of credit) but this abundance does not mean that the instruments are equally available to all companies. It tends to be the case that each of these instruments presupposes a minimum - often quite high - size threshold in the relationship with the lending financial operator, as well as an adequate credit standing of the company receiving the relevant credit. This means that, in most cases, the actual availability of these instruments is very limited or even absent.

Overcoming the limitations of the existing instruments means trying to imagine a solution similar to the venture capital market, a market for corporate commercial debt with characteristics that guarantee:

- a low level of risk for investors, by at least eliminating all the uncertainty factors implicit in the collectability of the trade receivable (disputes, offsets, defects in performance, ...). This condition could be achieved if it were the debtor company that placed its debt on the market, declaring its collectability;

- a high level of inclusiveness. A priori, any supplier company should be able to access the market to sell its receivables declared collectable by the debtor, regardless of its financial rating and size;

- a strong simplification in the processes of market entry and control for anti-money laundering purposes, avoiding multiplying them for all investors and referring them, perhaps, only to debtor companies, actual risk counterparties and market feeders.

In a scenario such as the one hypothesised, the criticality represented by long payment terms would be significantly reduced, especially for supply chains whose end point is a company with an adequate credit standing, and thus able to guarantee a sufficiently liquid market for its trade debt. An effective possibility of negotiating trade credit at market conditions and without prejudice to the supplier's financial soundness can neutralise the variable represented by longer or shorter payment terms for the company's financial equilibrium and allow it to share the financing of the overall production cycle with the customer, without taking on excessive risks and burdens.

The proposal

If the objective pursued in the revision of the Late Payment Directive is to mitigate the critical financial issues faced by SMEs in their business relations with larger firms, both the limits of merely sanctioning late payment solutions and the limits of imposing standardized payment terms that do not take into account the nature of individual activities and production cycles should be clear.

Given these limitations, a further possible solution is to incentivize the creation of active trade debt markets for larger firms by conditioning the application of payment terms above a certain level (e.g., 60 days) on a commitment to ensure the negotiability of the relevant invoices on an open and sufficiently liquid market.

Rather than intervening across the board by severely restricting the negotiating autonomy of the parties, regardless of any assessment of their actual interest, a more circumscribed intervention might yield better results. This does not mean abandoning the pursuit of vexatious behavior that exploits the size asymmetry between negotiating parties.

From this point of view, the current framework of the Directive could be confirmed and even implemented through the use of metrics based on balance sheet indicators, at least to sanction extreme behavior, which results in negative financial cycles, in which the company overall collects before it pays its suppliers. This type of situation, easily inferred from the annual financial statements, means that the company overall drains liquidity to its suppliers, operating as if it were a financial intermediary licensed to collect money from the public, but without providing any kind of guarantee or being subject to any kind of control. A behavior, therefore, potentially sanctionable in itself, regardless of any party complaint.

From an operational point of view, the proposed revision of the Directive could thus be articulated as follows:

Da un punto di vista operativo la proposta di revisione della Direttiva potrebbe quindi essere articolata come segue:

- Definition of a "normal" maximum payment term for commercial transactions;

- Faculty to agree on different, even longer terms, and possibility of agreeing on late payment interest at a different rate than the legal one provided that the ordering companies guarantee their suppliers the possibility of negotiating their credit without recourse in open and inclusive markets;

- Incentives aimed at the creation of such market platforms and the membership of firms and banks and financial operators in them. Incentives to firms could refer to favorable tax treatments for the costs incurred for the purpose of implementation and adherence, those towards financial intermediaries could take the form of a lower capital requirement for related uses, in addition to possible operational simplifications in terms of compliance requirements;

- Imposition of automatic penalties for grossly vexatious behavior, inferable a posteriori from companies' balance sheet ratios, possibly applicable only to companies above specified size thresholds. .

The overall objective of the proposal is to encourage the creation of more active commercial debt markets for firms, with the effect of improving the financing of their working capital and the use of capital in low-risk, high-turnover operations. This initiative, combined with the pre-existing sanctions system and its possible further implementations, could ensure more effective results with respect to the fundamental objective of hardening the financial balance of firms, while avoiding the negative effects of a system based solely on sanctions that can be activated only at the initiative of one party.

The proposal outlined here is nothing more than a generalization of the writer's business initiative.