Who consider the problem of managing the financial aspects of its own supply chain(s) rapidly comes across an observation: the supply chains are rarely homogeneous and the suppliers that compose them are usually very heterogeneous.

Managing the financial relations within the supply chain, designing supply chain finance programs, requires therefore an activity of supplier classification to identify clusters somewhat homogeneous, at least in relation to the purposes that the buyer company is aiming.

In this article we propose a very easy model to approach such activity of preliminary classification, assuming that the Buyer aims pursuing a set of finalities relatively broad and is available to use a range of instruments consistent with these purposes.

Calibrate the offer of Supply Chain Finance programs

In the following chart we present an example of purposes and related instruments (capital participation instruments and those related to specific activities, such as RTIs – Italian Temporary consortium -, are voluntarily excluded from the examination).

Purposes |

Instruments |

| Financially support critical suppliers, that is to say, those who – simultaneously – result being difficult to replace and financially weak: the goal is to neutralize the financial impact of the supply relationship on the supplier's business | Availability of credit, in the form of:

|

| Retain those suppliers who constitute important blocks of the Buyer's production processes and are difficult to replace or, in any case, particularly valuable | Availability of credit Operational, logistic, and administrative integration Reward systems connected to quantitative and qualitative objectives |

| Encourage certain behaviours or policies from suppliers (from environmental sustainability to financial sustainability, to the quality of processes and products) | Idem |

| Strategically use its own commercial debt, managing its duration and payment deadlines in a flexible manner | Negotiation of payment terms, by combining free and / or costly extensions Encourage the negotiation of supplier credits at market conditions |

The willingness of suppliers to participate in supply chain finance programs is conditioned by a number of circumstances related to the supplier's “financial strength”, to the relevance of the supply relationship (from its point of view), from any further benefits resulting from a more thorough integration with the customer.

Calibrating the supply of supply chain finance programs therefore requires weighing all these factors, with the objective of designing sufficiently flexible solutions to adapt to the wider range of subjective situations, consistent with the quantitative and qualitative objectives that it is proposed to achieve.

SCF, logics of integration and classification of suppliers

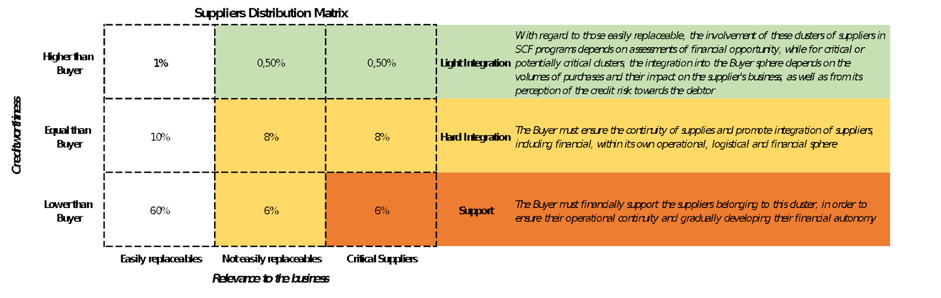

A simple way to segment a sufficiently diversified supplier portfolio is to distribute them in accordance with two drivers:- one that summarizes the relative importance of the supply relationship for the Buyer's activity, thus considering qualitative and quantitative considerations and including in the evaluation the impact on logistics and production processes. Having to define this driver, it can be referred to as “Relevance of the supplier to the business” and be declined in relation to the substitutability of the supplier itself within a period of time commensurate with any potential adjustment of the logistic and production process;

- the other is the creditworthiness of the supplier, not in absolute but in relation to that of the Buyer (creditworthiness does not mean dimension, even if it is often a proxy, but only the capacity to obtain credit at market conditions). Why in relation to that of the Buyer? Because, on the one hand, this provides some potential indication of the supplier's interest in financial solutions based on the Buyer's creditworthiness, and, on the other hand it suggests the possible opportunity to instead take advantage of the supplier's greater credit capacity, rather than "burn" its own.

The simplified result is a matrix as shown below, in which we also "invented" a potential distribution of suppliers in the different clusters.

Financial capacity of the Buyer and support to the supply chain

Some considerations on the result of this transposition into matrix, which is obviously only a tool for analysis and interpretation.

The areas of critical Suppliers and those not easily replaceable, crossed with the relative measure of creditworthiness, are segmented in three clusters, which correspond to different proposals:

- Support, that is to say a proposal based on an extended use of the Buyer's financial capacity, to ensure the operational continuity of suppliers and gradually develop their financial autonomy. This type of proposal must be conveyed to the financially weaker suppliers and can be articulated with the use of different intervention instruments;

- Hard Integration, is the cluster of suppliers with a creditworthiness comparable to that of the Buyer. In this case, the proposal should be aimed at a closer logistical, operational and administrative integration, even more than financial, with the objective of ensuring the continuity of the relationship and the elimination of unnecessary costs;

- Light Integration, is the segment of important suppliers that are totally independent from a financial point of view and to whom it is not advisable to offer support solutions under this profile. Their involvement in SCF programs can only be aimed at achieving the Buyer's financial objectives and must be supported by combining the creditworthiness of the supplier with that of the Buyer.

Then there is the usually more extensive area, composed of easily replaceable Suppliers, which is not automatically excluded from any consideration regarding involvement in SCF programs. The objectives become, in this case, more bluntly opportunistic and mainly financial. Thus, the mass of financially weaker suppliers can be offered solutions aimed at lengthening payment times rather than dynamic discounting operations, when the Buyer is very liquid, while longer payment terms can be negotiated with stronger suppliers.